By Chuka Okonkwo, Marketing Manager, FilmOne Entertainment

In early September, Demon Slayer: Infinity Castle opened at the Nigerian box office. By the end of its first weekend, it had earned ₦82 million. Within weeks, that figure passed ₦175 million; the highest box office return for an anime title in West Africa’s history. On the surface, it was a record. Beneath it, a signal.

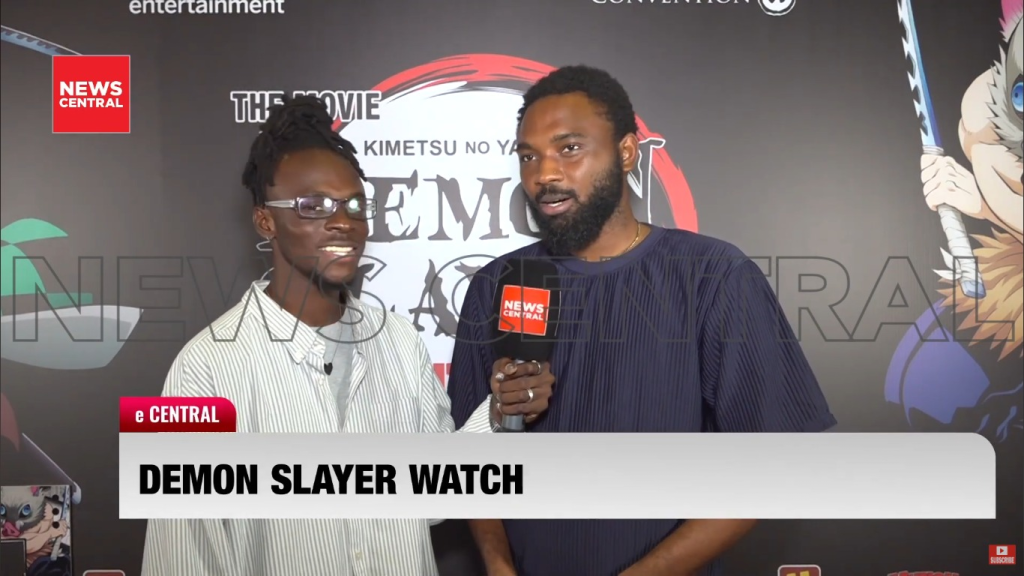

The turnout wasn’t driven by conventional marketing or star power, but from a communal partnership and a well-orchestrated experiential touchpoint for Nigeria’s anime fans and community – one that had never been tapped into in such a large scale.

This revealed more clearly than any campaign could that the anime fandom has matured into a market force in Nigeria’s entertainment economy.

At FilmOne Entertainment, we have long tracked audience behavior across genres, but Demon Slayer offered a rare case study: a niche product achieving mainstream penetration through community-led enthusiasm. Partnering with AniWe Convention, we saw how subcultures — when engaged rather than marketed to, can convert passion into predictable demand. The screenings at Filmhouse IMAX Lekki and Silverbird Jabi Mall were sold out, with repeat visits from fans who viewed the experience as collective, not transactional.

This success also highlights a broader shift in Africa’s cinema economy. The average Nigerian moviegoer is now younger, globally literate, and digitally networked. This demographic consumes stories in multiple languages and formats, and their loyalty is built on authenticity, not advertising. Their power lies in amplification; in turning engagement into visibility, and visibility into revenue.

Globally, film industries are recognizing this dynamic. In Japan and the U.S., anime franchises like Demon Slayer and Jujutsu Kaisen are not simply entertainment exports but ecosystems; driving merchandise, streaming demand, and event-based revenues. Nigeria’s own box office is beginning to mirror that diversification, with genres once considered niche now competing directly with local blockbusters.

The takeaway is strategic; the next phase of growth will not rely solely on volume or release frequency but on understanding the sociology of audiences, their communities, rituals, and digital footprints. Demon Slayer’s performance shows that content alignment with subculture can outperform broad-based marketing.

It is a reminder that the Nigerian cinema landscape is not static. It’s being redefined by audiences who bring their own communities with them; audiences that want to connect with similar crowds and see themselves in the shared space of the cinema hall.

The business of film is no longer about predicting what audiences want; it’s about recognizing that they already know, and are organizing around it.